Register to NIK-AI

Register to NIK-AI.

Already have an account? Login instead.

Register to NIK-AI.

Already have an account? Login instead.

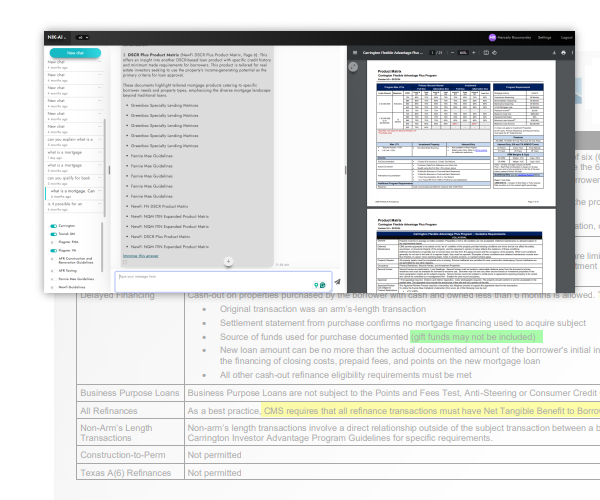

Navigating mortgage guidelines can be a daunting task for both lenders and borrowers. The intricate regulations often require a deep understanding of legal language and financial implications. Without guidance, even seasoned professionals can find it challenging to stay compliant and efficient.

With complementary AI tools such as NIKAI, loan officers are experiencing up to a tenfold increase in productivity. By automating routine tasks and providing real-time insights, these AI systems enable officers to focus on personalized client interaction, thereby improving efficiency and customer satisfaction.

NIKAI provides access to a comprehensive database of more than 100 lender guidelines, allowing loan officers to quickly reference specific criteria across a wide range of lenders. This breadth of information helps streamline the approval process, ensuring that officers have all necessary details at their fingertips.